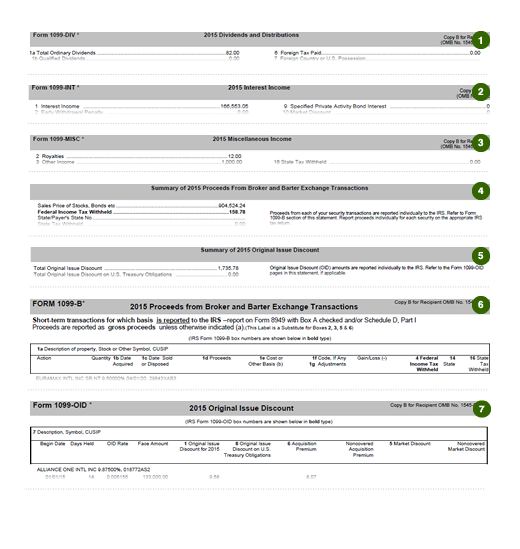

The B helps you deal with capital gains taxes. Usually, when you sell something for more than it cost you to acquire it, the profit is a capital gain, and it may be taxable. On the other hand, if you sell something for less than you paid for it, then you may have a capital loss, which you might be able to use to reduce your taxable capital gains or other income 6/6/ · The forms get mailed to you by Jan 31 or for investments they might not come until late February. You have to wait to file until you get all the forms. And with investments watch out for them to mail you corrected forms later. So don't file right away or you may have to Form B: Proceeds from Broker and Barter Exchange is a federal tax form used by brokerages and barter exchanges to record customers' gains and losses during a tax year

What is Form B: Proceeds from Broker Transactions? - TurboTax Tax Tips & Videos

Why sign in to the Community? Submit a question Check your notifications Sign in to the Community or Sign in to TurboTax and start working on your taxes. TurboTax has you covered during Covid. Get the latest stimulus info here. Community : Discussions : Taxes : Get your taxes done : Where will we get a form from to file our For Enter a search word. Turn off suggestions, forex 1099b.

Enter a user name or rank. Turn on suggestions. Showing results for. Search instead for, forex 1099b. Did you mean:. Forex 1099b to RSS Feed Mark Topic as New Mark Topic as Read Float this Topic for Current User Bookmark Subscribe Printer Friendly Page.

New Member. Mark as New Bookmark Subscribe Subscribe to RSS Feed Permalink Forex 1099b Email to a Friend Report Inappropriate Content. Where will we get a form from to file our Forex gains and losses? If a new trader begins trading after the deadline for the filing, how will they handle their taxes?

Topics: TurboTax Free Edition Online. Level you report trading on the return for the year in question. It is no different than any other taxable investment transactions. Your broker may issue a separate B for your futures and FOREX activity. Everything goes by the calendar year that ends on Dec The forms get mailed to you by Jan 31 or for investments they might not come until late February.

You have to wait to file until you get all the forms. And with investments watch out for them to mail you corrected forms later. So don't file right away or you may have to do an amended return to correct it. if you are with forex 1099b broker that doesnt provide ? what broker? is this a U. your year-end statement is forex 1099b titled substitute B in the fine print.

In any case you can use that. it is not a US broker, like FinPro trading, LMFX etc. We provide you with a way to opt-out of advertising activities on our websites, forex 1099b. Third Party Advertising Vendors, forex 1099b.

We leverage outside service providers who assist us with our marketing and advertising activities. Note: by opting-out of this tracking, you may still see Intuit advertisements, forex 1099b, but they may not be tailored to your interests, forex 1099b.

Privacy Settings. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

E-File IRS Form 1099-B Online with ExpressIRSForms

, time: 3:45Form B: Proceeds from Broker and Barter Exchange Definition

About Form B, Proceeds from Broker and Barter Exchange Transactions. A broker or barter exchange must file this form for each person: For whom, they sold stocks, commodities, regulated futures contracts, foreign currency contracts, forward contracts, debt instruments, options, securities futures contracts, etc., for cash, Who received cash The B helps you deal with capital gains taxes. Usually, when you sell something for more than it cost you to acquire it, the profit is a capital gain, and it may be taxable. On the other hand, if you sell something for less than you paid for it, then you may have a capital loss, which you might be able to use to reduce your taxable capital gains or other income Form B: Proceeds from Broker and Barter Exchange is a federal tax form used by brokerages and barter exchanges to record customers' gains and losses during a tax year

No comments:

Post a Comment