/07/14 · The most volatile forex pairs based on variation are: AUDJPY (average volatility of %) AUDUSD (average volatility of %) EURAUD (average volatility of %) NZDJPY (average volatility of %) GBPAUD (average volatility of %) GBPNZD (average volatility of /12/11 · CAD/CHF, EUR/CHF, AUD/CHF and CHF/JPY are the less volatility Forex pairs among the cross rates. The amplitude of their movements doesn’t exceed 60 points per day /01/21 · The least volatile currency pairs tend to be the major currency pairs which are also the most liquid. Also, these economies tend to be larger and Author: Rich Dvorak

10 �� Most Volatile Forex Pairs - ( Reviewed )

According to research in South Africathe most volatile currency pairs often offer enticing predictions for profit because their price movements can be more dramatic than less volatile pairs. Traders must remember that volatile currency pairs often have lower levels of liquidity than their less-volatile counterparts. A well-thought-out trading plan and risk management strategy is key. Download our free e-book. The pairing enjoys high volatility due to the inverse relationship between the Australian dollar and Japanese yen.

Contrariwise, the Japanese yen is widely considered to be a safe-haven currency, which means that investors often turn to it in times of economic adversity. As a result, the price movements of this pair can be very dramatic depending on the current global economic outlook. Volatility in this pair could decrease if a withdrawal agreement is made, but so far there has been no sign of consensus. The yen is seen as a safe haven, and the Canadian dollar is a commodity currency, with its value on the currency market heavily influenced by the price of oil on the commodity market.

Historically, these two currencies have been linked, mainly since Australia is part of the Commonwealth forex less volatile pair Nations. If the price of gold is rising, forex less volatile pair, the price of the dollar will most likely also increase against ZAR. The South Korean won, in its current form, was formed after the Second World War. Following a separation, the South allied with America and the North allied with Russia and as a result, the economic differences of capitalism and communism became apparent.

The won currently trades at around to one against the US dollar. Read 27? Best CFTC Regulated Forex Brokers — Reviewed What is the difference between trading currency pairs with high volatility versus low forex less volatile pair Currencies with high volatility will normally move more pips over a certain period than currencies with low volatility and this will lead to an increased risk when trading currency pairs with high forex less volatile pair. Currencies with a high volatility are more prone to slippage and due to high-volatility currency pairs making bigger moves, traders should determine the correct position size to take when trading them.

What are the least volatile currency pairs? There are 5 simple steps that will help traders to get start in trading forex volatility:. According to research in South Africa, forex less volatile pair, t he forex market is one of the biggest and most active markets in the world. By using different technical analysis indicators, fundamental analysis or a combination of both, traders evaluate the future movement of one currency in relation to another.

Technically speaking, forex trading is all about knowing what to trade and when it comes to the active trade of forex currency pairings, volatility is an essential part of most strategies. Volatility is an important consideration in everything from forecasting weather patterns to projecting the future price action of trades.

All currencies are defined according to the international standard code or ISO currency code and labelled with three-letter tags. A currency pair comprises of a base currency and a second, quote currency. The value following the currency pair symbolizes how many units of the quoted [second] currency equal one unit of the base currency.

Executing forex trade orders means that traders will buy the base currency and sell the quoted currency at the same time. A sell order would be performed by selling the base currency and buying the quoted currency. There are different categories of currency pairsincluding:. What is Forex Trading in general? The foreign exchange — FX or forex market is a global marketplace for exchanging national currencies against each other. Currencies trade against each other as exchange rate pairs.

The forex market is open 24 hours a day and 5 days a week, only closing down during the weekend. The market is largely made up of institutions, corporations, governments and currency speculators. Trading accounts in South Africa can be opened for a small amount, but a minimum USD deposit is advised because an traders account balance will determine how much leverage they can use. When it comes to Forex tradingthere are many different opinions floating about, forex less volatile pair. Of course, there is always a chance that traders will make unsuccessful trades and lose moneybut Forex trading is not the same as forex less volatile pair. If a trader has enough knowledge, understand the market and can implement strategies, they can master the FX trading and become extremely successful.

Forex trading may be risky business, South Africa included and while Forex trading is not a successful path for everyone, anyone can reach success in it. South Africa is a great example when it comes to the popularity of Forex trading. Each exchange, worldwide is open weekly from Monday through Friday and has unique trading hours, but the four most important time windows are as follows:.

While each exchange functions independently, all trade the same currencies, forex less volatile pair. Therefore, when two exchanges are open, the number of traders actively buying and selling a certain currency will dramatically increase. The bids and asks in one forex market exchange immediately impact bids and asks on all other, reducing market spreads and increasing volatility. The most favourable trading time is the 8 a.

to noon overlap of New York and London exchanges and from 5 p. Everybody knows that shop prices are not static and they can rise or fall at any time. Often times shoppers may pop into a shop and see that the price of for instance chocolate has risen, just to return the next day to see it has risen again — Why does the price rise so quickly? So simply put, volatility means the rate at which the price of chocolate can rise and it can be measured both as a percentage and in monetary units, forex less volatile pair.

Volatility is every so often associated with the price fluctuations or the amplitude of the price movements. Volatility is regarded by Forex traders as one of the most important informational indicators forex less volatile pair decisions on opening or closure of currency positions.

Volatility plays a very crucial role in risk assessment for financiers, forex less volatile pair. When traders say that market is highly volatile this means that currency quotations change drastically during a trading session. Identifying Stable Currencies and Volatile Currencies. While almost any currency can experience volatility certain currencies have a tendency to remain more stable against their peers and these will generally be currencies representing economies that have differentiated production of goods and services, low inflation, stable trade and balance of payments indicators, forex less volatile pair, stable political systems, balanced government accounts, and stable and predictable monetary policy.

While volatility patterns may change at any time, some currencies have gained a reputation for showing greater stability over time — including:.

The governments who back these currencies have developed reputations for maintaining sound public sector accounts and limited intrusion in market affairs. There are also major heavy-duty currencies that are viewed to maintain general long-term stability, including —. However, these are contrasted by the volatility of some major emerging market currencies, forex less volatile pair, which have been more powerfully affected by local policy shifts and global supply and demand factors.

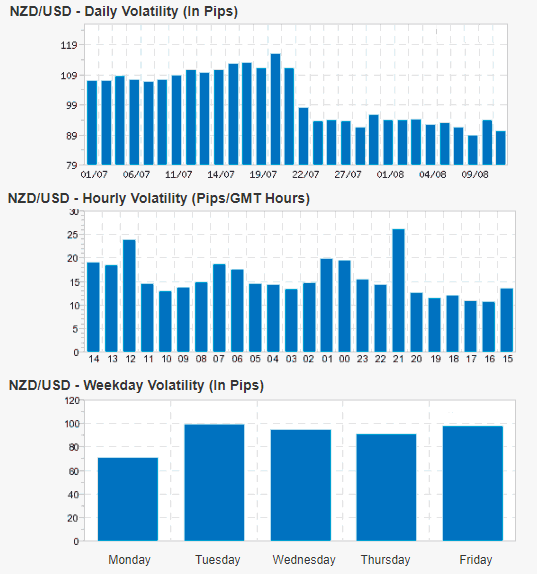

These include:. Many factors impact the market and affect its volatility including:. Apart from these factors, a forex trader must keep in mind what is happening around the world which could have massive impacts on volatility. Most volatile forex pairs. Currency pairs differ in terms of volatility levels and traders can decide to trade high volatile pairs or pairs with lower volatility. The volatility of a currency pair shows price movements during a specific period.

Smaller price movements will indicate lower volatility whereas higher or frequent movements mean higher volatility. The price movement of the forex less volatile pair pair is commonly considered in terms of pips, so if a currency pair moves by pips on average during a certain period it will be more volatile than a pair moving 20 pips in the same period. A volatility level is affected by major economic data releases, political events, liquidity or simple supply and demand.

The volatility of a currency pair can change over time as factors change. Exotic currency pairs are forex less volatile pair to be more volatile because of limited liquidity and unstable economic conditions in emerging economies.

Best Gold Trading Brokers — Reviewed Forex is the largest and most volatile market in the world with hundreds of currency combinations to choose from. In the end, the forex market is full of irregularities and it is very important to keep a close eye on the market determinants and indicators that measure the volatility, forex less volatile pair, according to research in South Africa. What are the factors that influence the volatility of currency pairs? Here is a list of the 10 Forex less volatile pair Volatile Forex Pairs.

What are the major forex currency pairs to trade? What is the forex less volatile pair forex pair to trade for beginners? What are the 5 most traded currencies in the world? EGM Securities spread list starts from 0. This applies to the Premiere account. On the Executive account, the broker charges 1. View Share. The EGM Securities demo account that is on offer with EGM Securities impersonates a live trading account.

With the account traders have access to […]. EGM Securities is a new online broker situated in Nairobi, Kenya. It was founded in and runs a Non-Dealing Desk NDD. This means […]. EGM Securities runs a Non-Dealing Desk NDD which means it provide direct forex less volatile pair to Interbank market exchange rates.

Trade executions are provided by using […]. Price and trade data source: JSE Ltd All other statistics calculated by Profile Data, forex less volatile pair. All data is delayed by at least 15 minutes. Read Review. Download Free ebook PDF. Skip to content Search. Get Free Stock Alerts - Sign Up Here. OPEN TRADING ACCOUNT. Best Forex Brokers South Africa Best Forex NO DEPOSIT Bonus Forex Courses Best FREE Forex Trading Apps �� Broker of the Month A — Z Forex Brokers Reviewed Best Forex Regulated Brokers High Leverage Forex Brokers Best Forex Trading Demo Accounts Best Forex Trading Strategies Best Forex Trading Tips Best CFD Trading Platforms Best Discount Forex Brokers Reviewed Currencies Dollar to Rand Euro to Rand British Pound to Rand Canadian Dollar to Rand Australian Dollar to Rand Rand to Rupee Crypto ICO Token of the Month Top 10 Cryptocurrencies What is Bitcoin?

Top 10 Most Volatile Currency Pair In The Market

, time: 9:51Forex Volatility - What Are The Most Volatile Currency Pairs? | Trading Education

Less volatile currency pairs will have undergone smaller price movements. In forex, price movements are often measured in pips. This stands for percentage in point (or price interest point) and is used to represent tiny shifts in value /01/21 · The least volatile currency pairs tend to be the major currency pairs which are also the most liquid. Also, these economies tend to be larger and Author: Rich Dvorak Least volatile pairs are eur/gbp and Aud cad & eur/chf because eur and pound ate correlated 70% of the but after the Brexit which has hit uk economy very hard we have seen pound has become more volatile but Australian dollar and canadian dollar usually move against each other 80% of time except in various individual high impact data relese, same can be said for eur/chf

No comments:

Post a Comment