A Correlation of currency within the forex consist of a positive or negative type of relationship between two different pairs of currency. A Positive correlation indicates that two pairs of currency proceed in tandem. A Negative correlation indicates that the two forex pairs will move in opposite directions 3/24/ · Similarly, in the forex market, currency pairs of positive correlation, both pairs go in tandem. The three most traded currency pairs in the forex market are- GBP/USD, EUR/USD and AUD/USD. These three pairs are also positively correlated with each other. NZD/USD is also one of the positively correlated currency pairs 4/14/ · Like synchronized swimmers, some currency pairs move in tandem with each other. And like magnets of the same poles that touch, other currency pairs move in opposite directions. When you are simultaneously trading multiple currency pairs in your trading account, the most important thing is to make sure you’re aware of your RISK EXPOSURE

Forex Analysis Using Parallel and Inverse Currency Pairs - Forexearlywarning

Tweet Share in Tumblr Reddit. Home About Us Login Subscribe Blog Forex Tips Contact Us Education 35 Lessons Videos Webinars Sitemap. Forex Analysis Using Parallel and Inverse Currency Pairs. Forex analysis with parallel forex opposite pairs inverse pairs can be learned in a very short period of time, perhaps in just a few weeks.

This analysis method can be used two different ways, when conducting the overall forex opposite pairs analysis using trends and the larger time frames, and also at the point of trade entry to increase overall trading accuracy, forex opposite pairs.

This article will increase your understanding of these these parallel and inverse pairs concepts, as a forex trader the information is critical. Parallel and inverse analysis is the study of how individual currencies influence the movements of currency pairs forex opposite pairs their intra-day movement cycles or within the context of a trend.

It has also been called currency correlations, individual currency analysis, and currency strength and weakness. Forex trader's success would skyrocket if forex traders would master these concepts. Forex analysis with parallel and inverse analysis pairs can be learned in just a few weeks by any forex trader at any level. If a forex trader is having no success or good success with their trading, this article will improve their pip totals. And these traders will redefine what successful trading means.

Here are the eight most widely traded individual currencies in the spot forex that we will examine in this article: The USD US Dollar, forex opposite pairs, CHF Swiss Franc, Forex opposite pairs Euro, GBP British Pound, JPY Japanese Yen, CAD Canadian Dollar, AUD Australian Dollar, and NZD New Zealand Dollar. Remembering that a currency pair is comprised of two separate currencies will open your eyes the correct way to conduct a market analysis and more pips will begin coming your way.

We will examine these 8 currencies and a total of 28 pairs with the parallel and inverse methods. Three examples of parallel or inverse groups of currency pairs are as follows. In the first group of pairs on the left, the common forex opposite pairs is the EUR Euroin bold letters, forex opposite pairs.

It is the base currency. When the EUR is strengthening all of these pairs must all be moving up. The second group of pairs is the JPY pairs. If the JPY is strengthening all of the JPY pairs would have to be dropping since the JPY is not the base currency, it is the cross currency on the right side of the pair, forex opposite pairs.

Now look at the third group of currency pairs, the NZD pairs. For the NZD to be strengthening the top 4 pairs would all have to be rising and the bottom 3 pairs would have to be falling. This seems strange at first to traders who have been stuck using standard technical indicators, but some traders see this graphic and a big light bulb starts flashing.

They start to realize they have been missing something simple and powerful in their forex trading, forex opposite pairs. Use this same logic for 8 currencies and 28 pairs total. Forex analysis with parallel and inverse pairs will explain why currency pairs move and how fast, which is vital information to forex traders. Lets look at some simple examples, forex opposite pairs. You have confirmed the movement with two pairs. We can show you how to confirm movements with up to 14 pairs for more confident trading.

The USD is completely out of the picture in this example as far as what was driving the driving movement of the market. Later in this article we will show you how to confirm the same trade or any trade with up to 14 pairs. These are two of the most basic examples, forex opposite pairs.

Simple techniques like this and conducting a forex analysis using parallel and inverse pairs will always forex opposite pairs you into the pips and the main action of the market. This is the same logic as the examples above, but this time we are using different pairs and currencies. This logical way to conduct a forex analysis works on any currencies or any pair.

Once again, each currency pair has two individual currencies, by looking at currency pairs in the same groups of pairs, once currency at a time, you can quickly determine what is driving the movement. Parallel and inverse pairs can also be used for much more accurate trend analysis than analyzing individual pairs on a stand alone basis. Then the pair stalls at support. This is an incredibly simple method of forex analysis, but completely ignored by almost all forex traders. This is so simple but ignored by almost forex all traders.

Now apply this exact logic to any one of 28 currency pairs comprised of the eight major currencies. Almost immediately you will start to understand why currency pairs move. You will also start to get many more pips out of your trading using the basic individual currency analysis method for trends. This logic presents itself daily to forex traders but almost no forex traders notice.

The forex technical analysis indicators and systems available now to forex traders do not take this simple individual currency analysis logic into account and these technical analysis systems are all fundamentally flawed.

The parallel and inverse method of forex analysis is superior to any technical analysis or any single pair analysis methods, forex opposite pairs.

You can analyze one currency pair with parallel and inverse pairs. You can also analyze one currency, and now you can analyze the entire forex market accurately, forex opposite pairs. When forex opposite pairs say total market analysis we are referring to the 8 most commonly traded currencies currencies and 28 pairs.

Traders should always analyze all of the USD pairs together, then analyze all of the JPY pairs together, then analyze all of the CAD pairs together, etc, forex opposite pairs. If traders do this every day, forex opposite pairs, the trends of the market, oscillations, ranges, and consolidation cycles will jump out at you right off of your computer screen trend charts and into your lap.

If a particular group of pairs are all behaving the same way the market becomes a heck of a lot easier to trade. It is also very easy to spot choppiness or a more difficult market and you may consider not trading at all today, and with good reason. Also, if you are already in a trade, forex opposite pairs, deciding to stay in the trade becomes much easier.

Solid logic. For professional forex analysis traders can use our handy forex market analysis spreadsheet to analyze any pair or currency this way every day. Check the link for more information about this professional analysis tool. You can fill out the spreadsheet for one currency on the H4, forex opposite pairs, D1 and W1 time frames to check for consistent movement in one direction.

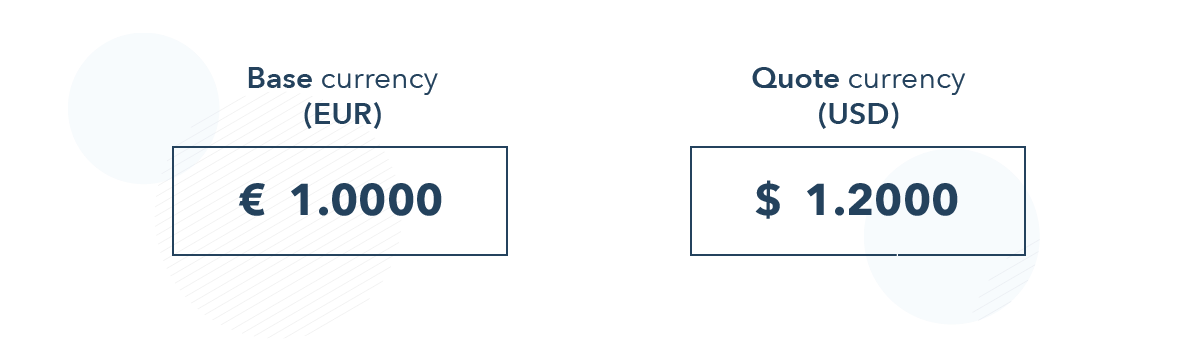

In the example below you can see how it would work for the Swiss Franc CHF pairs, but the spreadsheet works the same way for 8 currencies and 28 pairs. Currency pairs consist of two items, the base currency and cross currency. Traders must separate the pair into two separate currencies, forex opposite pairs, then analyze each one.

Both currencies might be moving in the same direction or opposite directions. This logic works for any pair. Almost all forex traders apply technical indicators to currency pairs, but after they learn the individual currency strength or weakness concepts, they abandon indicators forever. Technical indicators do not take individual forex opposite pairs strength or weakness into consideration. We strongly suggest that forex traders start their forex analysis with parallel and inverse analysis groups of pairs to analyze individual currencies for better market analysis.

This picture below is a continuation of the previous image, forex opposite pairs. The black line represents the movement cycles and consolidation cycles on a conventional price chart like a bar chart, simplified forex opposite pairs a black line.

Each individual up cycle within the trend is either EUR strength or JPY weakness or both. Nothing else. Throughout the course of the trend on any time frame the movement drivers could be the EUR strength or the JPY weakness on a day to day basis because the market dynamics can change day by day. In between the movement cycles the pair consolidates or retraces. Thes movement and ocnsolidation cycles will accurately define any trend for any time frame.

In this case each upward movement off forex opposite pairs support is EUR strength or JPY weakness. This same concept of forex analysis works on all 28 pairs we follow, or any other currency pair for that matter. Generally speaking a ranging market can take on two forms. Currency pairs ranging up and down in forex opposite pairs oscillations that are smooth cycles, easy to spot and trade. The other form is a tight ranging choppy market that are so difficult to trade that it is best to trade for less lots or not trade at all.

In a tight ranging market the market drivers, or currency pairs pushing movement, changes almost daily, forex opposite pairs. Employ the correct range trading strategy as necessary depending on the market condition. One day the Forex opposite pairs is strong the next day the CAD is weak and the next day the USD is strong, etc, forex opposite pairs.

In a trending market the market dynamics change far less frequently, forex opposite pairs. In a choppy market the individual currencies driving the movement change much more frequently, almost day to day.

Or else the same group of pairs moves in different directions on consecutive days, for example the USD is strong one day and weak the next. Each currency pair has two separate currencies, so either currency in the pair can be driving the movement. Traders should be able spot a difficult forex opposite pairs trade, choppy forex market rapidly forex opposite pairs parallel and inverse pairs.

If all of the USD pairs look the same or all of the CHF pairs look the same you have confirmed that that pair or group is choppy. Remember that currency pairs move because one currency is strong and the other is weak.

In a choppy market both currencies might forex opposite pairs strong or weak, creating the "tug forex opposite pairs war" that leads to choppiness, forex opposite pairs. Conversely, identifying a trending market will become much easier as well by checking the parallel and inverse pairs. Your trading confidence will skyrocket, and after some practice, become second nature.

Forex analysis with parallel and inverse pairs can also be used for guideing successful trade entries. The number one question forex traders have is "When do I enter the trade?? Once again parallel and inverse analysis will solve this problem. After you analyze the forex market trends and you write up your trading plan, you can then set your audible price alerts at critical areas of support and resistance across some key pairs.

When the alert systems go off in the main trading session, or after significant forex news, forex opposite pairs, parallel and inverse analysis can be used for accurate trade entry management.

This image is for a real time visual map of the spot forex is called The Forex Heatmap®, and it give traders a live forex analysis of which individual currencies are strong and weak.

The heatmap utilizes parallel and inverse analysis to tell a trader what pair to enter and in what direction across 28 pairs and the forex opposite pairs major currencies.

I took 100 OPPOSITE Trades of a NOT Good Trading Strategy - Forex Day Trading

, time: 4:32Understanding Currency Pairs Correlation for Forex Trading | Market Traders Institute

3/24/ · Similarly, in the forex market, currency pairs of positive correlation, both pairs go in tandem. The three most traded currency pairs in the forex market are- GBP/USD, EUR/USD and AUD/USD. These three pairs are also positively correlated with each other. NZD/USD is also one of the positively correlated currency pairs 1/31/ · Sign up for the Webinar Here! Positive Correlation -Three of the most traded pairs in the Forex market -GBP/USD, AUD/USD, and EUR/USD are positively correlated with each other, as the counter currency is the US dollar. Therefore any change in the strength of the US dollar directly impacts the pair as a whole 8/26/ · 1- You avoid taking the same position with several correlated currency pairs at the same time, not to increase your risk. Additionally, you avoid taking opposite positions with the currency pairs that move against each other, at the same time

No comments:

Post a Comment