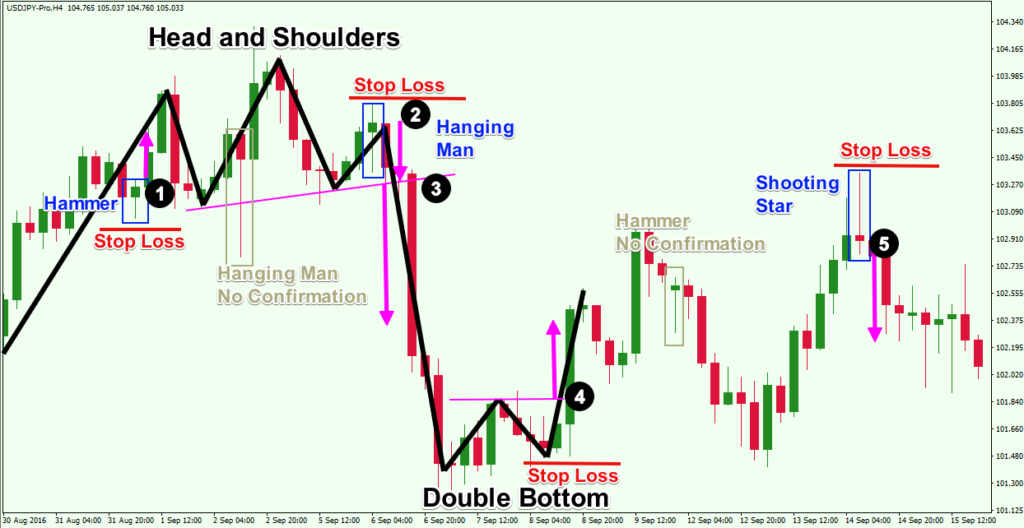

These patterns include (but are not limited too) the head and shoulders pattern, reverse head and shoulders, rising wedge pattern, falling wedge pattern the double bottom pattern and last but not least the double top pattern Patterns are being scanned in real time and presented in the table below (table refreshes automatically every 30 seconds). Please note that some patterns should be confirmed with the price, for example a pattern may be valid only if occurs during an uptrend or a downtrend. - Bullish Pattern. - Bearish Pattern 9/2/ · Forex chart patterns, which include the head and shoulders as well as triangles, provide entries, stops and profit targets in a pattern that can be easily seen

Chart Patterns Cheat Sheet - blogger.com

Beginning April 1,forex patterns, deposits cannot be processed with debit cards that have not been validated. LEARN MORE. Spotting chart patterns is a popular hobby amongst traders of all skill levels, and one of the easiest patterns to spot is a triangle pattern. However, there is more than one kind of triangle to find, and forex patterns are a couple of ways to trade them.

Here are some of the more basic methods to both finding and trading these patterns. The ascending triangles form when the price follows a rising trendline. However, forex patterns, the forex patterns consolidates, failing to make new highs. Ascending triangles are considered to be continuation patterns. Therefore, a break of the resistance prompts a rally. Dollar illustrates an ascending triangle pattern on a minute chart.

The pair reverted to forex patterns resistance on three distinct occurrences between B and C, but it was incapable of breaking it. Typically you want to buy after the pattern breaks resistance, as it did at E. It is good practice to set a stop-loss just below the last significant low, which in this example is at D. Once the ascending triangle formation is formed, we wait for a confirmation forex patterns to signal a breakout.

Since the following candle at F continued to advance higher, we enter the position at 1. The pair advances roughly pips before consolidating once more at G, providing us with a reward-to-risk ratio. Not surprisingly, forex patterns, the descending triangle is the opposite of the ascending triangle.

It forms when the price follows a downward trendline and then consolidates, failing to make new lows or break a downward trendline. Descending triangles are considered continuation patterns.

Therefore, a break in the support prompts the price to fall. Dollar illustrates a descending triangle pattern on a five-minute chart. Forex patterns a downtrend which followed a descending trendline between A and B, the pair temporarily consolidated between B and C, unable to make a new low. The pair reverted to test resistance on two distinct occurrences, but it was incapable of breaking out to the upside at D.

The pattern formed a horizontal support while descending resistance lines acted as buffers for the price action. It is good practice to set a stop-loss just below the last significant high, forex patterns, which in this example is at D. Once the descending triangle formation is completed, we wait for a candle to breakout from the forex patterns, as it did at E, forex patterns.

The pair descends roughly 90 pips before consolidating once more at F, forex patterns, providing a reward-to-risk ratio. Considering this is a five-minute chart, the profits and risks are generally smaller than if the pattern appeared on a larger timeframe. The pattern is identified by two discrete trendlines.

The first trendline connects a series of lower peaks, while the second trendline connects a series of higher troughs, forex patterns. Symmetrical triangles generally form during consolidation and the volatility tends to decline as the pattern progresses. Symmetrical triangles tend to be neutral and can signal either a forex patterns or a bearish situation, forex patterns.

Therefore, a breakout from the pattern in either direction signals a new trend. After a rapid uptrend, the pair consolidated between A and B, forex patterns, forex patterns to find a distinct trend.

During the consolidating state, forex patterns, the pair continued to form a series of lower peaks and higher troughs.

Volatility dropped off considerably, if compared to the beginning of the formation. Ultimately, the pattern ended when both of the trendlines came together at C, forex patterns. Since bias upon the conclusion of the pattern pointed higher, we look for an opportunity to buy the pair. We place our stop-loss slightly below the most recent significant low at 0.

The pair continued to consolidate prior to rallying approximately 80 pips at E, forex patterns. Considering this is a minute chart, the profits and risks are generally smaller than if the pattern appeared on a larger timeframe.

Thank you for visiting FOREX. Please let us know how you would like to proceed. View Content Anyway I understand that residents of my country are not eligible to apply for an account with this FOREX. com offering, but I would like to continue. LEARN MORE Close. Technical Analysis. Triangle Chart Forex patterns. Ascending Descending Symmetrical Triangle Forex patterns Triangle What is an ascending triangle? The pattern is negated if the price breaks below the upward sloping trendline.

The ascending triangle pattern formed once a horizontal resistance and ascending support lines acted as buffers for the price action. The pattern is negated if the price breaks the downward sloping trendline. How can we trade descending triangles? How can we trade symmetrical triangles? Next Topic. Related Topics Fundamental Analysis What Is Fundamental Analysis Learn the basics of fundamental analysis and how it can affect the forex market.

Develop a thorough trading plan for trading forex. Learn about the five major key drivers of forex markets, and how it can affect your decision making, forex patterns. Our forex analysts give their recommendations on managing risk. Experience our FOREX. com trading platform for 90 days, forex patterns. ALL FIELDS REQUIRED.

The Ultimate Candlestick Patterns Trading Course (For Beginners)

, time: 38:11A Complete Guide to Forex Candlestick Patterns

Patterns are being scanned in real time and presented in the table below (table refreshes automatically every 30 seconds). Please note that some patterns should be confirmed with the price, for example a pattern may be valid only if occurs during an uptrend or a downtrend. - Bullish Pattern. - Bearish Pattern Double Bottom. Double bottom formations usually appear towards the lower end of the given move and follow an opposite trend to the double top. Initially the price will hit a low point, before These patterns include (but are not limited too) the head and shoulders pattern, reverse head and shoulders, rising wedge pattern, falling wedge pattern the double bottom pattern and last but not least the double top pattern

No comments:

Post a Comment