The most important part is that during a scaling-out, your trade size in contracts needs to be large enough to take one-third of your position out when you feel the signal to do it. You can take out another third with another signal afterwards. The last third stays until the end. Scaling out can be like an insurance policy to lock profit You need to follow the steps below to do that correctly: Pre-determine where you’ll add your additional units. Calculate your risk with the additional units. Trail your stop losses to keep growing the size of your position within the chosen risk blogger.comted Reading Time: 6 mins By scaling out two lots and holding two lots, the trader has taken a profit but still has some upside and is running a break even stop on the remaining profitable lot. This works for an even number of lots like 2, 4, 6, 8 10 lots, etc, any even number. So using the rule of thumb in this case is a great way to manage forex profits

Top Stop Loss Tips: Scaling Out and Scaling In Technique

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies.

You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site, forex scaling out. Note: Low and High figures are for the trading day.

Article Summary: Trading is part art, and part science — and nowhere is this art more prevalent than when it comes to closing positions. Many traders will close the entire position with one action, but scaling out can present some clear advantages to traders.

Below, forex scaling out, we will discuss those advantages and how traders can look to use them beneficially. In our previous article, we investigated the topic of scaling in to positions.

This article will discuss how traders scale out of positions, and when they may want to utilize this type of trade management. Why Would Traders Scale Out of Positions? The primary reason that traders would look to scale out of positions is greed; and to the trader's line - this can be a good thing.

Quite frankly, we never know how long a trend might continue, or how many pips might be generated from a single position. Scaling out allows the trader to observe the market, removing parts of the position as the market moves in their favor. Traders will also commonly look to utilize break-even stops when using a scale-out approach in order to remove their initial risk. As a priority - t hey know they want to avoid The Number One Mistake that FX Traders Makeso they are looking for an absolute minimum of 50 pips on the reward side of the trade.

If they decide to use a 1-to-1 risk-to-reward ratio, the trader is likely looking at one of two outcomes: Either a 50 pip stop, or a 50 pip limit. But what if the market keeps moving in their direction? This is where things get f un for the trader using a scale out approach, as our trader can essentially close additional pieces of the position as price continues to move in their favor, forex scaling out.

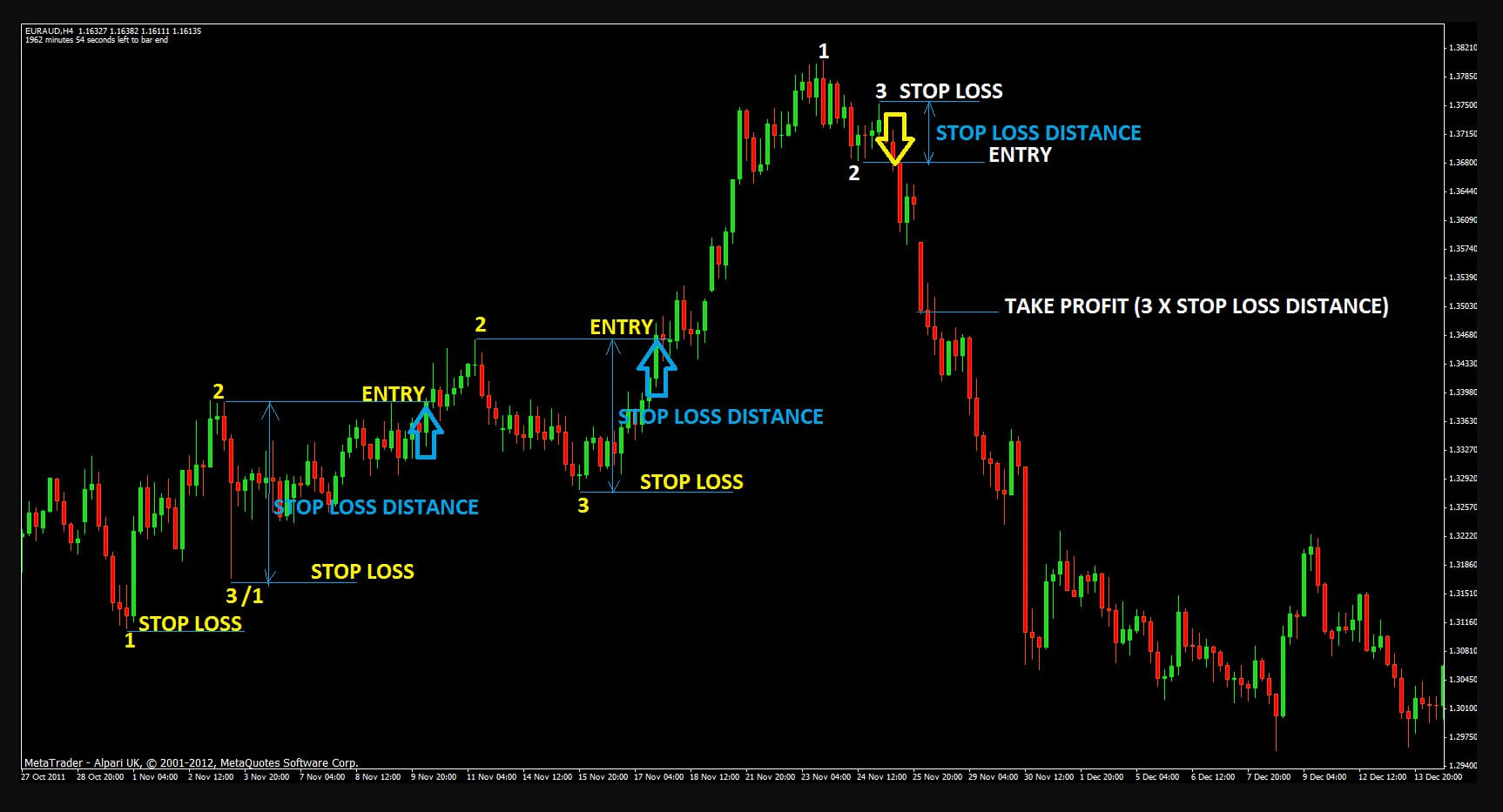

If EURUSD moves up pips, the trader can choose to take off another ¼ of the position, and perhaps even adjust their break-even stop deeper in the money in order to lock in additional gains. If price moves another 50 pips, they can look to scale out of another ¼ of the position. The picture below illustrates further:. Scaling out allows additional return, with no additional risk if stops are adjusted. The primary benefit of this type of trade management is that if the EURUSD is going to embark upon a big move, our trader can potentially capture a much larger portion of this move forex scaling out if they had settled for a 50 pip limit on the trade.

With ranges, support and resistance is often well-defined; and if price is going to test resistance in the case of long positionsor support in the case of short positionsforex scaling out, then why should traders cut their potential gains short by taking profits any sooner on any parts of the lot? In trending, or breakout markets - prices are moving with a bias in one direction.

This increases volatility, as the faster price moves in one direction - the higher the probability of a reversal in the opposite direction. These reversals can quickly wipe out gains, which is one of the reasons that a trailing stop can be such a beneficial tool for traders using these trade management strategies. Ne xt: What You Need To Know About Your Trade Position Size Strategy 12 forex scaling out Previous: How to Scale In to Positions. To contact James Stanley, please email JStanley DailyFX.

You can follow James on Twitter JStanleyF X. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading forex scaling out appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Forex scaling out Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info on how we might use your data, see our privacy notice and access policy and privacy website. Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Forex scaling out 0. Duration: min. P: R:. Search Clear Search results.

No entries matching your query were found. English Español Français Deutsch 中文(繁體) 中文(简体). Free Trading Guides. Please try again, forex scaling out. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines.

Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements.

Forex scaling out Our guide explores the most traded commodities worldwide and how to start trading them, forex scaling out. Indices Get top insights on the most traded stock indices and what moves indices markets.

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar. Exports YoY APR. P: R: Balance of Trade APR. Ai Group Manufacturing Index APR.

Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides, forex scaling out.

Company Authors Contact. of clients are net long. of clients are net short. Long Short. Oil - US Crude. News Oil Price Forecast: WTI Crude Resumes Climb on Bullish Demand Oil - US Crude IG Client Sentiment: Our data shows traders are now net-short Oil - US Crude for forex scaling out first time since Apr 14, when Oil - US Crude traded near 6, Wall Street. News Gold Prices May Fall as US PCE Data Sends Yields, Dollar Higher Gold Price Pares Post-Fed Gain Amid Rise in US Treasury Yields More View more.

Learn Forex: How forex scaling out Scale Out of Positions James StanleySenior Strategist, forex scaling out.

The picture below illustrates further: Scaling out allows additional return, with no additional risk if stops are adjusted Created by J. Stanley The primary benefit of this type of trade management is that if the EURUSD is going to embark upon a big move, our trader can potentially capture a much larger portion of this move than if they had settled for a 50 pip limit on the trade.

When to Scale-Out? Ne xt: What You Need To Know About Your Trade Position Size Strategy 12 of 50 Previous: How to Scale In to Positions Written by James Stanley To contact James Stanley, please email JStanley DailyFX. Elliott Wave Analysis With Jeremy Wagner Podcast Financial Market Outlook Amid US-China Trade Talks Podcast How will Brexit affect the US? Economist Julian Jessop Answers Podcast html'; this. createElement 'script' ; s. js'; s. setAttribute 'data-timestamp', new Date ; d. head d.

forex scaling out s ; }. Market News Market Overview Real-Time News Forecasts Market Outlook. Market Data Rates Live Chart. Calendars Economic Calendar Central Bank Forex scaling out. Education Trading courses Free Trading Guides Live Webinars Trading Research Education Archive. DailyFX About Us Authors Contact Archive. First Name: Please fill out this field.

How to scale in your trades and maximize your profit potential

, time: 12:40Forex Money Management - Scaling Out Is A Must

The most important part is that during a scaling-out, your trade size in contracts needs to be large enough to take one-third of your position out when you feel the signal to do it. You can take out another third with another signal afterwards. The last third stays until the end. Scaling out can be like an insurance policy to lock profit By scaling out two lots and holding two lots, the trader has taken a profit but still has some upside and is running a break even stop on the remaining profitable lot. This works for an even number of lots like 2, 4, 6, 8 10 lots, etc, any even number. So using the rule of thumb in this case is a great way to manage forex profits You need to follow the steps below to do that correctly: Pre-determine where you’ll add your additional units. Calculate your risk with the additional units. Trail your stop losses to keep growing the size of your position within the chosen risk blogger.comted Reading Time: 6 mins

No comments:

Post a Comment