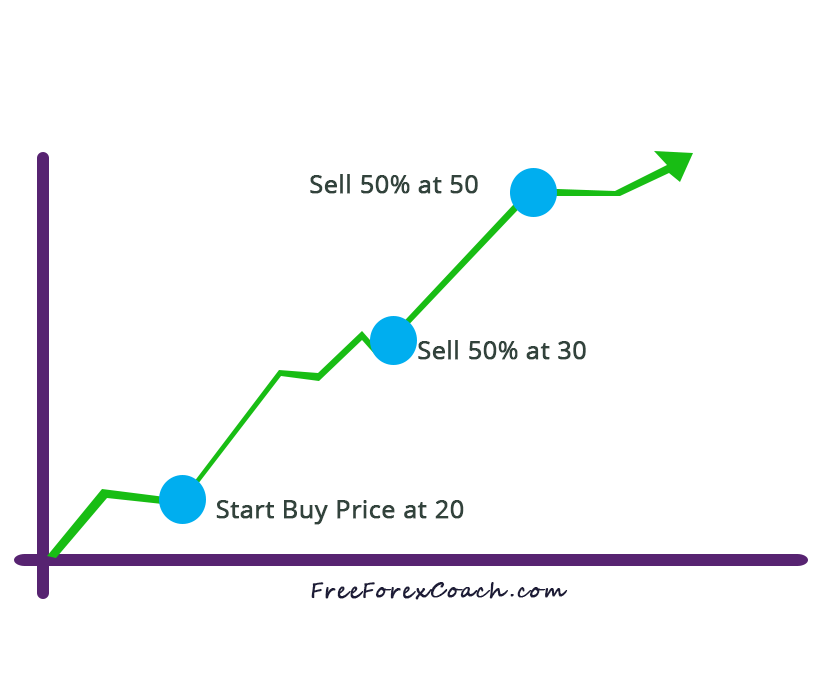

01/11/ · By “scaling out”, I mean take a portion of your trade off the table and into your trading account, and proceed accordingly. And there is no need to over-complicate this. Taking half off now, and half later is perfectly fine. It’s what I do Scaling out. Scaling out of a trade is used for achieving similar goals as scaling in – risk reduction, lock in profits, limit losses. Scaling out means to sell a fraction of your total exposure after your position has become profitable, thus locking in some profit, while leaving other positions open in order to benefit, if prices continue to advance 14/04/ · Example: Scaling out of EUR/USD Let’s say you have a $10, account and you shorted 10k units of EUR/USD at You placed your stop at and your profit target is pips below your entry at With 10k units of EUR/USD (pip value of this position is $1) and a stop of pips, your total risk is $, or 1% of your account

Scaling In And Out Of Positions In Forex - blogger.com

As mentioned earlier, scaling out has the obvious benefit of reducing your risk as you are taking away exposure to forex scaling out market…whether you are in a winning or losing position. You placed your stop at 1.

From here, forex scaling out, you can adjust your stop to breakeven 1. If the pair moves back higher and triggers your adjusted forex scaling out at 1. Ignore the dragon trying to bring his scales out. The decision to take some profit off the table is always up to you… you just have to weigh the pros and cons. In this example, the trade-off is a better profit versus the peace of mind of a smaller locked-in profit and creating a risk-free trade.

Remember, forex scaling out, there is the possibility of the market moving beyond your profit target and adding more bling-bling to your account. Scaling into positions, if done correctly, will give you the benefit of increasing your max profit. If done incorrectly, the value of your account could drop faster than you can even think about clicking the close button on your trade.

Partner Center Find a Broker. Next Lesson How To Scale In Positions. The starting point of all achievement is desire. Napoleon Hill.

How to scale out in MetaTrader 4

, time: 2:13How To Scale Out Of Positions In Forex - blogger.com

01/11/ · By “scaling out”, I mean take a portion of your trade off the table and into your trading account, and proceed accordingly. And there is no need to over-complicate this. Taking half off now, and half later is perfectly fine. It’s what I do Scaling In and Out of Positions You can actively manage your overall risk by scaling in and out of positions. Simply said, scaling means adding or removing units from the position size of your trade. This means, you add to your positions when the trade is profitable, and close some of your positions when the trade goes against you The most important part is that during a scaling-out, your trade size in contracts needs to be large enough to take one-third of your position out when you feel the signal to do it. You can take out another third with another signal afterwards. The last third stays until the end. Scaling out can be like an insurance policy to lock profit

No comments:

Post a Comment