Hedging exchange risk is a strategy that should be considered during periods of unusual currency volatility. Because of their investor-friendly features, currency ETFs are ideal hedging instruments 10/31/ · Hedging makes transactions, cash flows, and cost structures more stable and predictable. The different tools for hedging against foreign exchange risk usually involve contracts for Video Duration: 6 min 3/12/ · How Does the Forex Hedge and Hold Strategy Work? Hedging is all about reducing your risk, to protect against unwanted price moves. Obviously the simplest way to reduce the risk, is to reduce or close positions. But, there may be times where you may only want to temporarily or partially reduce your exposure

Chapter Hedging foreign exchange risk

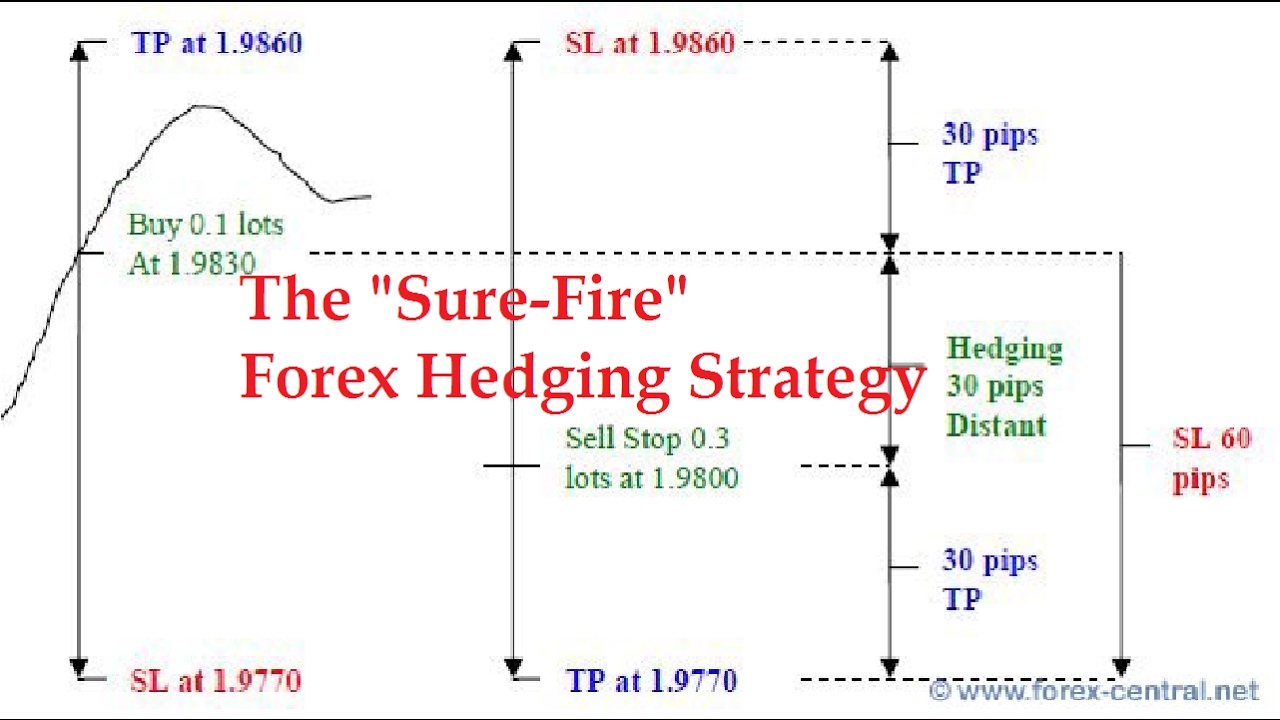

Hedging is a popular trading strategy deployed to protect opened positions in the forex market from adverse events. Traders, as well as forex robotsdeploy the short term protection strategy whenever there is concern that news or upcoming events would lead to adverse events that could trigger losses on an open position. Forex hedging is, therefore, hedging against forex risk, the process of trying to offset the risk of price fluctuations by reducing the impact of unwanted exposure.

With forex hedging, traders, as well as, forex expert advisors engage in automated fx trading, opening additional positions to mitigate against losses on an open position. Traders hedge in the forex market as a way of protecting themselves against exchange rate fluctuations. Hedging makes it possible to mitigate the loss or limit the loss to a known amount. As one of the most important money-making hack in the forex marketif you feel that a currency pair is about to decline in hedging against forex risk, one of the most important forex trading secrets is to hedge as a way of reducing short term losses while protecting long term profits.

As the name goes, simple forex hedging entails opening an opposite trade to the one that is already opened. The direct hedging strategy allows one to accrue profits as price moves downwards hedging against forex risk mitigating against losses accrued by the long position.

The net profit in a direct hedge is usually zero as the two open positions cancel each other. However, such a play allows one to keep the original position waiting for a trend to reverse and start moving in the direction of the previously opened position. The simple forex hedging strategy allows traders, as well as FX Expert Advisors, to generate profits on the new trade even as the first trade makes losses, hedging against forex risk.

Failure to hedge a position and opting to close the trade would mean accepting the loss. Instead, such brokers opt to net off two positions.

Multiple currencies heading strategy is a unique type of forex hedging whereby traders or FX Expert Advisors select two currency hedging against forex risk that are positively correlated. While hedging, one would take positions in the two currency pairs, but the opposite direction. However, upon further analysis of upcoming news events, it becomes clear that the USD is likely to strengthen against the EUR for a short period.

However, it is important to note that opening a hedge using more than a currency pair does trigger an increased level of risk. While the net balance is often zero with a direct hedge, hedging against forex risk, that is not the case with multiple currency hedge. In most cases, hedging against forex risk is usually a possibility of one position netting more profit than the other position makes in losses. Options are some of the best forex trading instruments often used in the forex market for hedging purposes.

Unlike other currency hedging tools, options giver traders a chance to reduce exposure while only paying for the cost of holding the option. Hedging strategies are popular trading strategies among experienced traders, as well as, Algorithmic FX Trading systems programmed to undertake such complex traders. The strategy entails opening new positions, in the forex market, as a way of reducing exposure to currency risk. Save my name, email, and website in this browser for the next time I comment.

Click or touch the Key. Home Strategies The Best Forex Hedging Strategy And Risks Involved. Check out our list of best hedging against forex risk robots. RELATED ARTICLES MORE FROM AUTHOR. How to Navigate Your Way Through Margin Calls, hedging against forex risk. How to Trade Using the Falling Wedge Pattern. Best Indicators for Trend Following Strategy. LEAVE A REPLY Cancel reply.

Please enter your comment! Please enter your name here. You have entered an incorrect email address! USD - United States Dollar. You must be aware and willing to accept the risks to invest in the markets. Never trade with money you can't afford to lose. Past performance of any results does not guarantee future performance.

Therefore, hedging against forex risk, no representation is being implied that any account can or will achieve the results indicated in this website. EVEN MORE NEWS, hedging against forex risk. What Are Guaranteed Stop Loss Orders in Forex? April 30, How to Navigate Your Way Through Margin Calls April 29, Lucky Gold Scalper Review.

Disclaimer Privacy Policy About Us Get In Touch.

ACCA AFM 6 7 The use of derivatives to hedge against forex risk external hedging – MMH Payment

, time: 8:47Tools for Hedging Foreign Exchange Risk - Finance Class [ Video] | blogger.com

Forex hedging is the process of opening multiple positions to offset currency risk in trading. The foreign exchange markets can be affected by adverse conditions, such as changing interest rates or inflation, so traders aim to protect their open positions by bulling or selling additional assets to reduce the overall risk of exposure 5/7/ · Forex hedging is, therefore, the process of trying to offset the risk of price fluctuations by reducing the impact of unwanted exposure. With forex hedging, traders, as well as, forex expert advisors engage in automated fx trading, opening additional positions to Hedging implies protection against the risk of future price fluctuations of assets arranged in advance. This method allows insurance against unwanted exposure to the risks that resulted from trading in the Forex market and other financial transactions

No comments:

Post a Comment